Assessing Financial Sector Performance: Insights for Forward-Thinking Investors

Assessing Financial Sector Performance: Insights for Forward-Thinking Investors

The health and performance of the financial sector offer valuable insights into an economy’s current state and its future potential. For astute investors, closely observing these indicators can help identify profitable investment opportunities before they become mainstream. This article aims to provide forward-thinking investors with key insights into assessing financial sector performance, particularly within the global stock market context.

The Importance of the Financial Sector

The financial sector comprises a wide range of industries such as banking, insurance, real estate, and capital markets, just to name a few. These entities facilitate transactions, provide avenues for saving and investing, offer lending and credit facilities, and insure against risk – all functions vital for a functioning economy.

Due to its substantive role and the interdependencies between it and other sectors, analyzing the performance of the financial sector can gauge the health and trajectory of the wider economy. Understanding the sector’s health, therefore, is key to constructing an investment strategy that aligns with your risk tolerance and return expectations.

Gauging the Health of the Financial Sector

Here are some key indicators investors can monitor to assess the health of the financial sector:

- Interest Rates: Rising interest rates can increase profitability for banks and other financial institutions as they earn more from lending.

- Real Estate Performance: Boosts in real estate performance signal boosts in mortgage activity, which can be a boon to banks’ and insurers’ bottom lines.

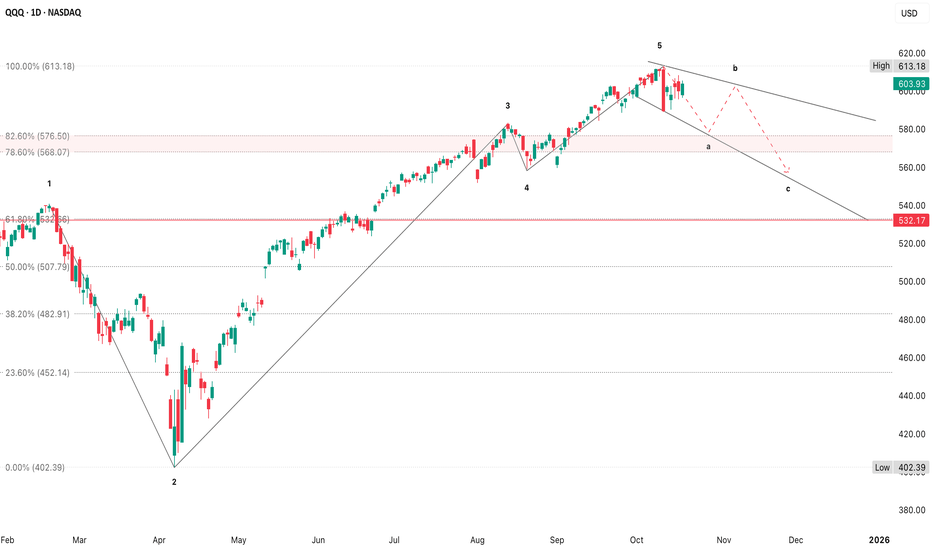

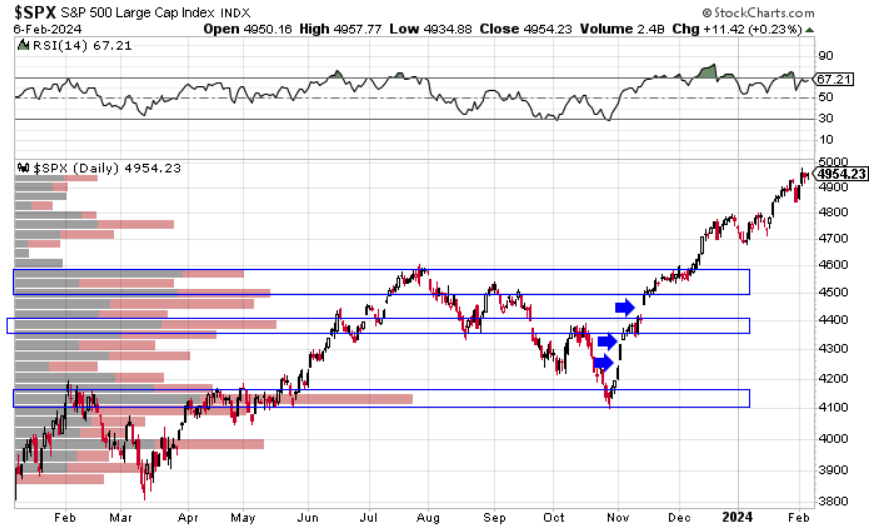

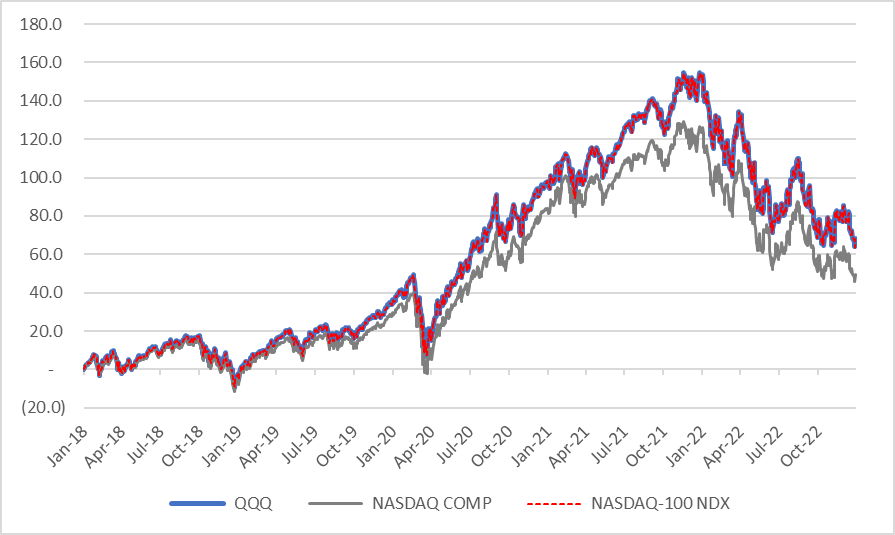

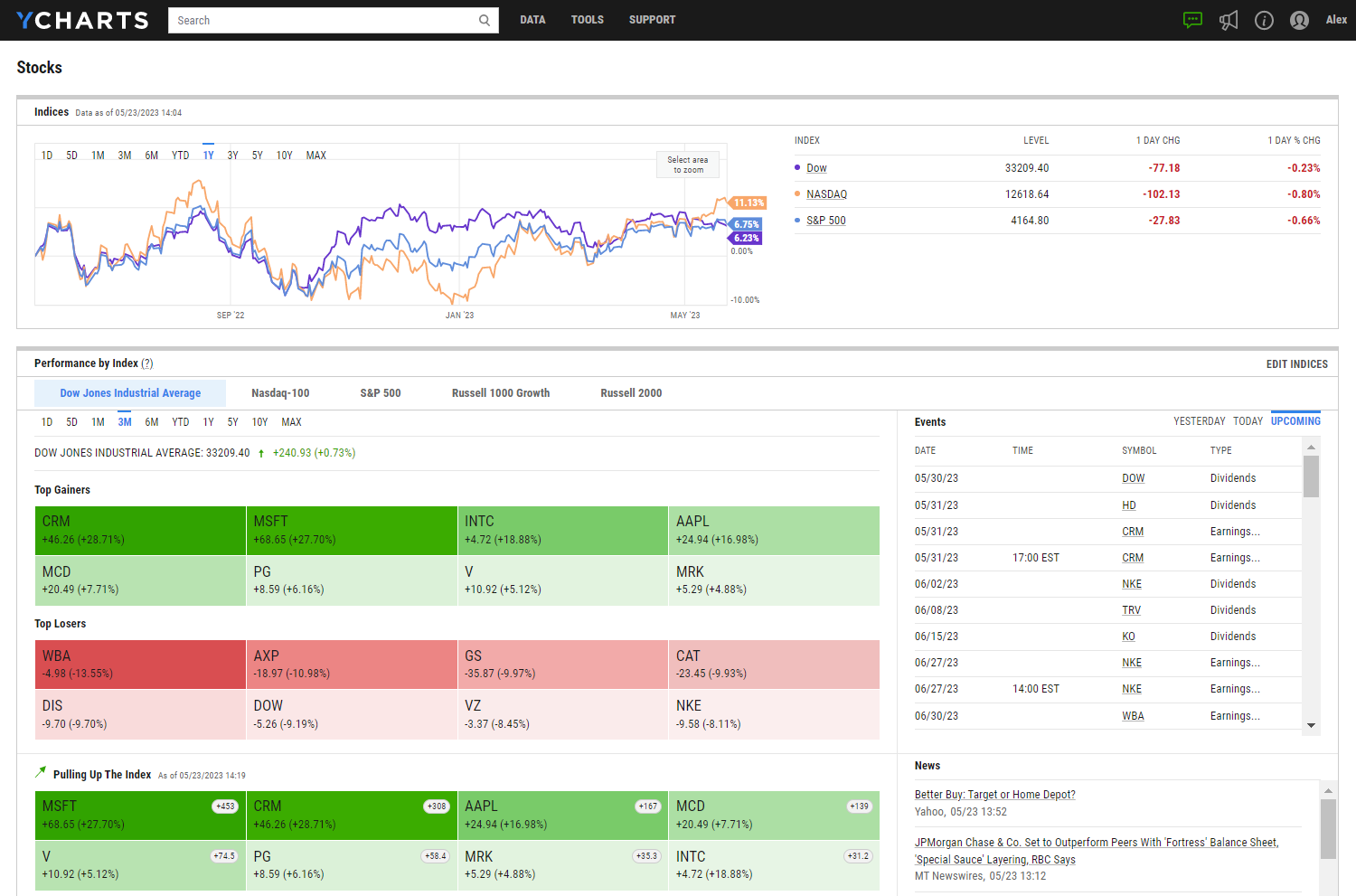

- Stock Market Trends: Rising markets can point to an improving economy and increased eagerness for risk, bolstering the financial industry.

Financial Sector Performance within the Global Stock Market Context

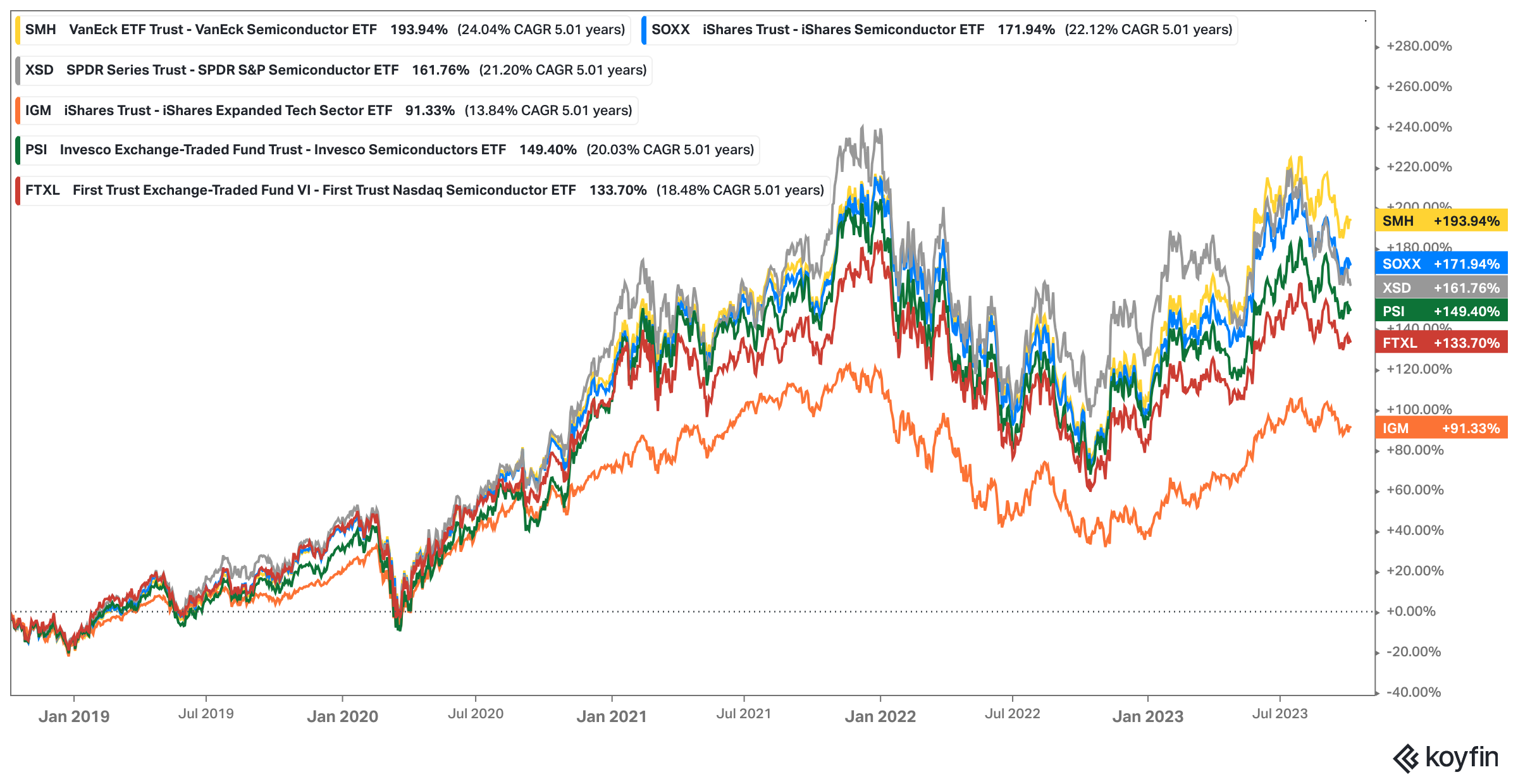

Stock market indices, such as the S&P 500 Financials Sector and the MSCI Global Financials Index, offer a snapshot of the financial sector’s performance on a regional, national, and international scale. By tracking these indices, investors can situate the performance of their investments in the broader market context.

Studying the correlations between these indices and the broader market can also provide early warning signs of trouble. For instance, ahead of the 2008 financial crisis, financial stock indices dramatically underperformed relative to the overall market—a clear red flag in retrospect.

Therefore, indices serve as valuable tools for forward-thinking investors seeking to navigate global financial turbulence and locate portfolio growth opportunities in the process.

RELATED READING

- Evolving Financial Markets and the Implications for Investors

- The Role of Financial Sector Performance in Portfolio Strategy

- How Financial Sector Health Affects Global Economic Performance

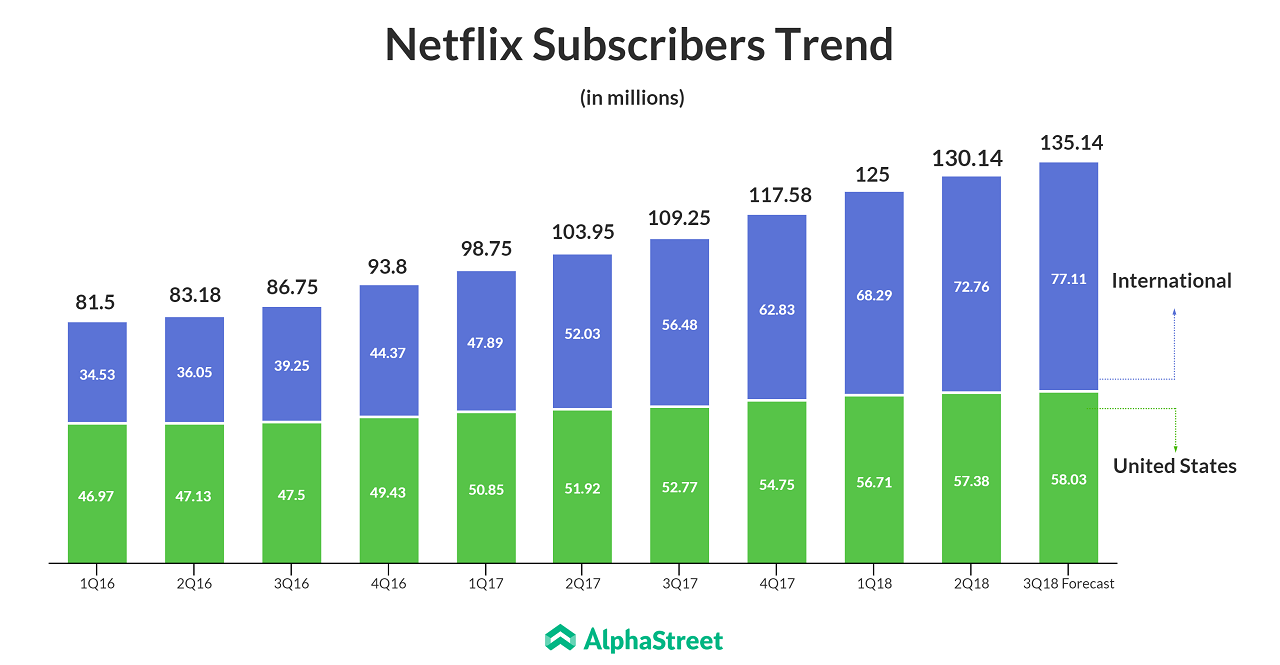

Read also: Analyzing Global Market Trends: The 2022 Forecast for Netflix Shares

Read also: Analyzing Global Market Trends: The 2022 Forecast for Netflix Shares

Read also: Analyzing Global Market Trends: The 2022 Forecast for Netflix Shares

Disclaimer

The content in this article is for informational purposes only and should not be construed as financial advice. Always consult your financial advisor or conduct thorough research before making investment decisions.

.png)